eth btc yahoo Exploring the Dynamics of Cryptocurrencies

eth btc yahoo sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In the world of cryptocurrencies, Ethereum and Bitcoin stand out as titans, each with distinct functionalities and a robust historical backdrop. This exploration delves into their unique characteristics, market trends, technological frameworks, and the evolving regulatory landscape that shapes their future.

Overview of Eth and BTC

The cryptocurrency landscape has been primarily dominated by Bitcoin (BTC) and Ethereum (ETH) since their inception. This article provides a comparative analysis of both, exploring their core functionalities and historical development.

Comparison of Ethereum and Bitcoin

Bitcoin, launched in 2009, is the world's first decentralized digital currency, often referred to as "digital gold" due to its limited supply and commodity-like characteristics. Ethereum, introduced in 2015, extends the capabilities of blockchain technology by enabling smart contracts and decentralized applications (dApps). While Bitcoin primarily serves as a medium of exchange and a store of value, Ethereum's platform allows developers to create and deploy a wide range of applications, making it more versatile.

Core Functionalities of Eth and BTC

- Bitcoin’s primary function is as a peer-to-peer payment system, allowing users to send and receive funds without intermediaries.

- Ethereum enables the creation of smart contracts, self-executing agreements with the terms directly written into code, facilitating complex transactions and automation.

- Both platforms are secured by their respective blockchain technologies but serve distinct purposes within the cryptocurrency ecosystem.

Historical Context of the Development of Eth and BTC

Bitcoin was created by an anonymous person or group known as Satoshi Nakamoto, aiming to provide a decentralized alternative to traditional financial systems. Ethereum was proposed by Vitalik Buterin after his realization that Bitcoin's scripting language was limited. The launch of Ethereum introduced innovative features like the Ethereum Virtual Machine (EVM), which allows for greater flexibility in programming and deploying applications.

Market Trends for Eth and BTC

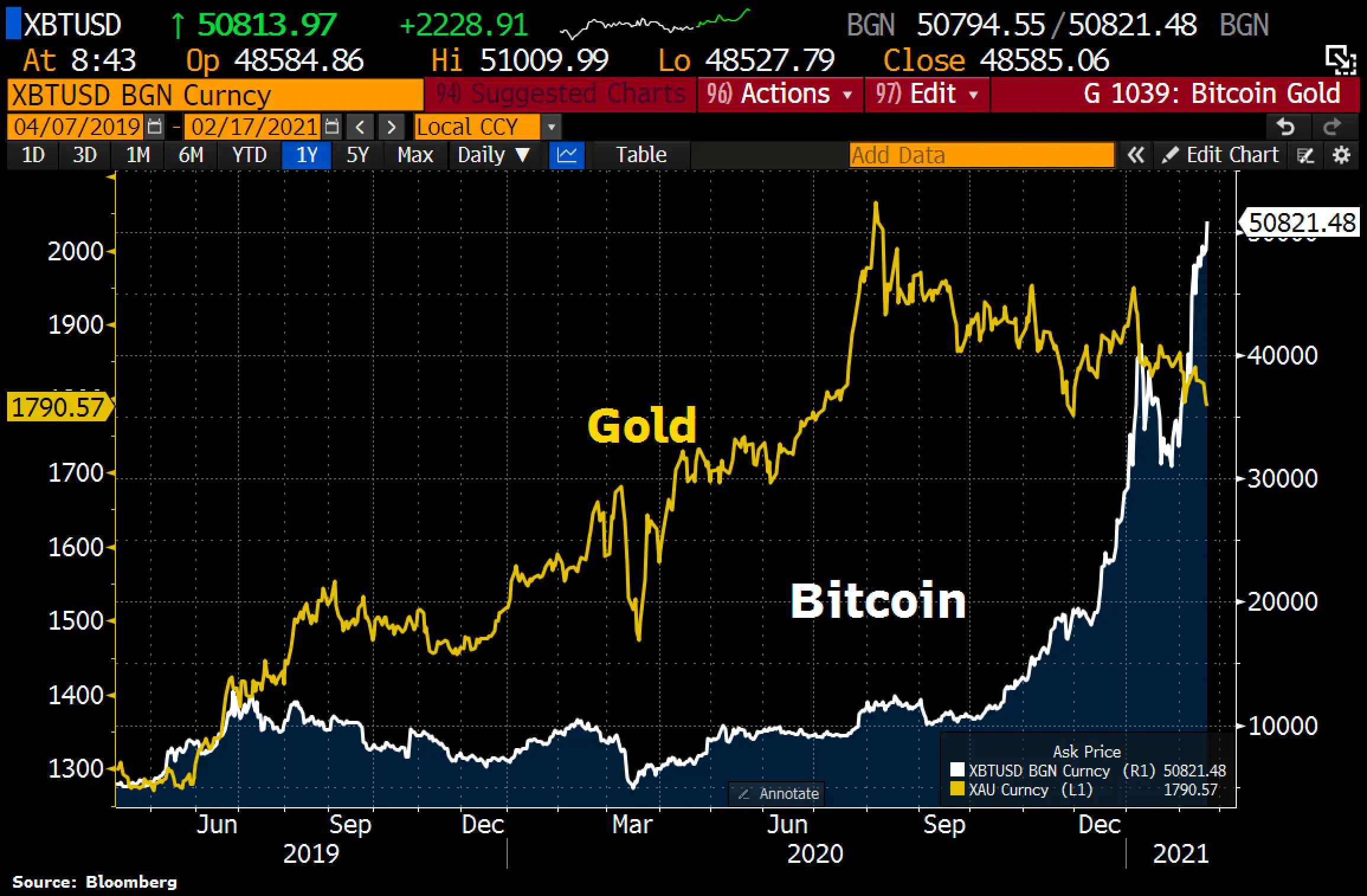

The cryptocurrency market has seen significant volatility in recent years, particularly for Bitcoin and Ethereum. Understanding market trends is essential for investors and enthusiasts alike.

Recent Market Trends for Ethereum and Bitcoin

In recent months, Bitcoin has experienced a surge in price driven by increased institutional adoption and interest from retail investors. Ethereum, on the other hand, has gained traction due to the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs), which utilize its blockchain.

Impact of Global Events on Prices of Eth and BTC

Global economic events, such as inflation concerns, regulatory news, and market sentiment shifts, have directly impacted the prices of both cryptocurrencies. For example, announcements from central banks regarding interest rates can lead to fluctuations in market confidence, influencing the trading behavior of participants.

Trading Volume Fluctuations of Both Cryptocurrencies

Statistics reveal that Bitcoin's trading volume often spikes during bull markets, while Ethereum's volume has increased significantly as DeFi protocols gain popularity. On average, Bitcoin maintains a higher daily trading volume compared to Ethereum, but ETH's growth rate in trading activity has been notable.

Technological Differences

Understanding the technological differences between Ethereum and Bitcoin is crucial for grasping their unique advantages and applications.

Technological Framework Behind Eth and BTC

- Bitcoin operates on a proof-of-work (PoW) consensus mechanism, requiring miners to validate transactions through computational power.

- Ethereum is transitioning from PoW to a proof-of-stake (PoS) system, which aims to enhance scalability and reduce energy consumption.

Unique Features of Ethereum's Smart Contracts

Ethereum's smart contracts differentiate it from Bitcoin by enabling conditional transactions that automatically execute when predefined criteria are met. This technology underpins many of the dApps within the Ethereum ecosystem, facilitating innovation in various sectors.

Consensus Mechanisms Used by Eth and BTC

- Bitcoin relies on PoW, which, while secure, can be resource-intensive and slow.

- Ethereum's upcoming PoS aims to enhance transaction speeds and reduce environmental impact, making it more sustainable for future growth.

Investment Opportunities

Investors are increasingly looking into opportunities in both Bitcoin and Ethereum, each offering unique strategies and risk profiles.

Investment Strategies for Eth and BTC

- Dollar-cost averaging (DCA) is a popular strategy where investors gradually accumulate assets over time to mitigate volatility.

- Long-term holding (HODLing) is favored by many Bitcoin enthusiasts, viewing it as a hedge against inflation.

- Ethereum investors often engage in staking, particularly as the network transitions to PoS.

Risk Factors in Investing in Ethereum versus Bitcoin

Bitcoin is often viewed as a safer asset due to its established market dominance, while Ethereum presents higher potential rewards due to its innovative technology and growing ecosystem. However, it also carries risks related to technological changes and competition from other blockchain platforms.

Future Value Projections for Both Cryptocurrencies

Analysts project that Bitcoin may reach new all-time highs as institutional interest continues to grow, while Ethereum's value could increase significantly with the expansion of DeFi and NFT markets. Both cryptocurrencies have shown resilience, indicating potential for future appreciation.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies is evolving, presenting challenges and opportunities for Bitcoin and Ethereum.

Regulatory Challenges Faced by Eth and BTC

Different countries have taken varying stances on cryptocurrencies, from outright bans to regulatory frameworks. The lack of a unified approach can create uncertainty for investors.

Governmental Policies Affecting Trading of Eth and BTC

Government regulations, such as tax laws and trading restrictions, can significantly influence market dynamics. Clear guidelines can promote adoption, while stringent regulations may hinder growth.

Recent Regulations Impacting Both Cryptocurrencies

Recent regulations in countries like the United States and China have created waves in the market. For instance, China’s crackdown on cryptocurrency mining and trading has led to significant price movements for both Bitcoin and Ethereum.

Use Cases and Applications

Beyond speculation, Bitcoin and Ethereum have real-world applications that highlight their utility.

Real-World Use Cases for Ethereum

Ethereum powers various applications, including:

- Decentralized finance (DeFi) platforms that facilitate lending and borrowing without intermediaries.

- Non-fungible tokens (NFTs) that allow digital ownership of unique assets.

Bitcoin as a Store of Value and Medium of Exchange

Bitcoin is increasingly seen as a store of value, akin to gold, while also being used for transactions in certain regions. Its limited supply and recognition as a digital asset contribute to its appeal.

Examples of Decentralized Applications Built on Ethereum

Prominent dApps include Uniswap for decentralized trading and Aave for lending protocols, showcasing Ethereum’s capacity for innovation.

Community and Ecosystem

The communities surrounding Bitcoin and Ethereum play a critical role in their development and adoption.

Communities Surrounding Ethereum and Bitcoin

Both communities are passionate and engaged, contributing to the ecosystems through development, advocacy, and education.

Role of Developers and Contributors

Developers are essential in advancing each platform. For Ethereum, the community continuously works on upgrades like Ethereum 2.0, while Bitcoin developers focus on improving scalability and security features.

Community-Driven Projects Related to Eth and BTC

Community initiatives such as Bitcoin meetups and Ethereum hackathons foster collaboration and innovation, driving the ecosystem forward.

Trading Platforms and Tools

A variety of trading platforms and tools are available for investors in both Bitcoin and Ethereum.

Trading Platforms for Ethereum and Bitcoin

Popular platforms include Binance, Coinbase, and Kraken, providing users with access to a wide range of cryptocurrencies and trading pairs.

Tools for Tracking Eth and BTC Market Trends

Investors use tools like CoinMarketCap and TradingView to analyze price trends and market data, helping them make informed decisions.

Setting Up Automated Trading Strategies

Automated trading strategies can be established using tools like trading bots, which allow users to execute trades based on predefined criteria without constant monitoring.

Media Coverage and Public Perception

The portrayal of Bitcoin and Ethereum in the media significantly influences public perception and market dynamics.

Portrayal of Ethereum and Bitcoin in Mainstream Media

Mainstream media coverage often emphasizes Bitcoin's volatility and Ethereum's innovation, shaping public understanding and investment interest.

Public Sentiment Regarding Both Cryptocurrencies

Public sentiment fluctuates based on market trends and news events, impacting trading behavior and overall market stability.

Media Coverage Effects on Market Dynamics

Positive or negative media coverage can lead to rapid price movements, highlighting the importance of responsible reporting in maintaining market integrity.

Future of Eth and BTC

Looking ahead, both Ethereum and Bitcoin face exciting prospects shaped by technological advancements and market trends.

Potential Future Developments in Ethereum and Bitcoin Ecosystems

Ethereum's transition to PoS and Bitcoin's potential integration with payment systems may redefine their roles in the global economy.

Emerging Trends Influencing Future of Both Cryptocurrencies

Trends such as the growing interest in DeFi, NFTs, and institutional adoption are poised to reshape the landscape for both cryptocurrencies.

Technological Advancements Shaping the Future

Advancements in blockchain technology, scalability solutions, and interoperability between cryptocurrencies could enhance their utility and adoption rates in the coming years.

Concluding Remarks

In conclusion, understanding eth btc yahoo provides valuable insights into the fascinating interplay between Ethereum and Bitcoin, highlighting their unique attributes, current market dynamics, and future potential. As both cryptocurrencies continue to evolve, staying informed about their developments will empower investors and enthusiasts alike to make informed decisions in this fast-paced digital economy.

General Inquiries

What is the main difference between Ethereum and Bitcoin?

Ethereum is designed for decentralized applications and smart contracts, while Bitcoin primarily serves as a digital currency and store of value.

How do I buy Ethereum or Bitcoin?

You can purchase Ethereum or Bitcoin through various cryptocurrency exchanges or trading platforms.

What are the risks of investing in cryptocurrencies?

The risks include market volatility, regulatory changes, and potential security vulnerabilities.

Can Ethereum replace Bitcoin in the future?

While Ethereum offers unique features, Bitcoin remains the first and most recognized cryptocurrency, making it unlikely to be completely replaced.

How do global events impact the prices of Eth and BTC?

Global events, such as regulatory announcements or economic shifts, can significantly influence investor sentiment and, consequently, the prices of both cryptocurrencies.