Bitcoin Ethereum Altcoins Analysis In The Crypto Realm

Kicking off with bitcoin ethereum altcoins analysis, the world of cryptocurrencies has become an increasingly vibrant and complex landscape, capturing the attention of investors and tech enthusiasts alike. As we delve into this analysis, we’ll explore the foundational principles of Bitcoin, the innovative features of Ethereum, and the myriad altcoins that populate the market.

From understanding how digital currencies function to examining market trends and investment strategies, this comprehensive overview will provide you with insights that are essential for navigating the evolving crypto space.

Overview of Bitcoin

Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, operates on a decentralized network utilizing blockchain technology. This digital currency is based on the principle of peer-to-peer transactions, eliminating the need for intermediaries like banks. The security of transactions is ensured through cryptographic techniques, making Bitcoin a pivotal player in the world of digital currencies.Bitcoin's historical development is marked by significant milestones.

Initially, it was a niche interest primarily among tech enthusiasts, but it gained wider recognition following its meteoric price rise in 2017. The first major milestone was the release of the Bitcoin whitepaper in 2008, followed by the mining of the first block, known as the genesis block, in January 2009. Over the years, Bitcoin has faced various challenges, including regulatory scrutiny and scalability issues, but has also seen increasing adoption by retailers and institutional investors.The advantages of using Bitcoin include its decentralization, which enhances security and reduces the risk of fraud.

Additionally, Bitcoin transactions can be conducted globally with relatively low fees. However, there are disadvantages, such as its high volatility and the potential for being used in illicit activities due to its pseudonymous nature.

Understanding Ethereum

Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Launched in 2015 by Vitalik Buterin and a team of co-founders, Ethereum distinguishes itself from Bitcoin by providing a flexible programming environment that allows for complex transactions beyond simple currency exchanges. This functionality opens up a range of use cases, including decentralized finance (DeFi) and non-fungible tokens (NFTs).Smart contracts are self-executing contracts where the terms of the agreement are directly written into code.

They eliminate the need for intermediaries, thereby reducing costs and increasing efficiency. The implications of smart contracts are profound, as they enable trustless transactions and can automate various processes across industries.When comparing scalability solutions, Ethereum is actively working on improvements such as Ethereum 2.0, which aims to transition from a proof-of-work to a proof-of-stake consensus mechanism. This transition is expected to enhance transaction speed and reduce energy consumption.

In contrast, Bitcoin's scalability solutions primarily involve layer-two solutions like the Lightning Network, which aims to facilitate faster transactions without overloading the main blockchain.

Analyzing Altcoins

Altcoins, or alternatives to Bitcoin, have emerged to serve various niches within the cryptocurrency ecosystem. Some notable altcoins include Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and Cardano (ADA). These cryptocurrencies can be categorized based on their use cases, such as payment solutions, privacy-focused transactions, and platform development.In the cryptocurrency space, utility tokens are designed to provide access to a product or service, while security tokens represent an investment in an underlying asset.

Understanding the differences between these two types is crucial for investors, as they come with different regulatory implications and use cases.Several factors influence the valuation of altcoins, including market sentiment, technological advancements, and adoption rates. Additionally, the overall performance of Bitcoin often impacts altcoin valuations, as Bitcoin is seen as a market leader.

Market Trends and Performance

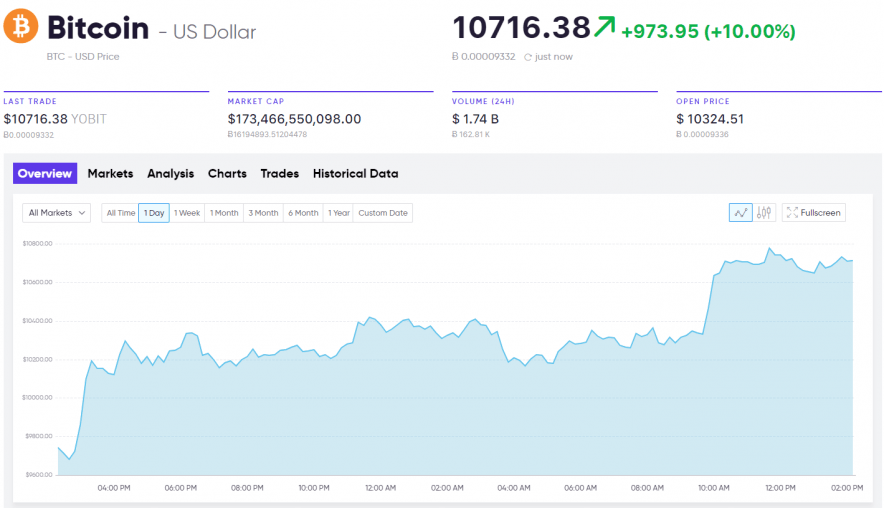

Recent market trends indicate a growing interest in Bitcoin, Ethereum, and altcoins, with increased trading volumes and market capitalization. In 2023, Bitcoin reached new all-time highs, while Ethereum continued to expand its ecosystem with various DeFi projects. Key performance indicators to monitor in the cryptocurrency market include market capitalization, trading volume, and price volatility. Keeping an eye on these metrics helps investors gauge the health of the market.Here is a comparison of market capitalization and transaction volumes for major cryptocurrencies:

| Cryptocurrency | Market Capitalization (USD) | Transaction Volume (24h) |

|---|---|---|

| Bitcoin (BTC) | $800 Billion | $30 Billion |

| Ethereum (ETH) | $400 Billion | $15 Billion |

| Ripple (XRP) | $25 Billion | $1 Billion |

| Litecoin (LTC) | $10 Billion | $500 Million |

Investment Strategies

Investing in Bitcoin, Ethereum, and altcoins requires a well-thought-out strategy. One effective approach is to adopt dollar-cost averaging, which involves regularly investing a fixed amount regardless of market conditions. This method mitigates the impact of volatility and helps in building a long-term position.Risk management techniques are essential to safeguard investments. Setting stop-loss orders and diversifying investments across different cryptocurrencies can help manage potential losses.

Additionally, investors should stay informed about market developments and adjust their strategies accordingly.Diversification within a cryptocurrency portfolio is crucial, as it helps spread risk. By investing in a mix of established cryptocurrencies and promising altcoins, investors can capitalize on growth opportunities while minimizing exposure to any single asset's downturn.

Regulatory Environment

The regulatory landscape surrounding Bitcoin and Ethereum is continually evolving. Various countries have adopted different approaches, from outright bans to supportive regulations that foster innovation within the cryptocurrency space. For instance, the United States has seen regulatory clarity through agencies like the SEC and the CFTC, which have provided guidelines for digital asset classification.Regulations significantly influence altcoin development and adoption.

For example, stricter regulations in certain jurisdictions can hinder the growth of new projects, while supportive frameworks can encourage innovation and investment.Notable regulatory actions include the European Union's proposed Markets in Crypto-Assets (MiCA) regulation, aimed at providing a comprehensive regulatory framework for cryptocurrencies. Such actions reflect the growing recognition of cryptocurrencies in the global financial system.

Future Outlook

Potential technological advancements that may influence Bitcoin and Ethereum include improvements in blockchain scalability and energy efficiency. For instance, Ethereum's transition to a proof-of-stake model is expected to reduce energy consumption and enhance transaction speeds, positioning it favorably for future growth.Altcoins are likely to play a significant role in the evolving cryptocurrency ecosystem. As more projects emerge that address specific challenges, such as privacy and interoperability, they will contribute to a more robust and diverse market.Based on current data, market trends in the coming years may be characterized by increased institutional adoption, the rise of decentralized finance, and greater regulatory clarity.

As the cryptocurrency market matures, investors can expect new opportunities and challenges that will shape the future landscape.

Concluding Remarks

In conclusion, the landscape of Bitcoin, Ethereum, and altcoins presents both opportunities and challenges for investors and users alike. By staying informed about market trends, regulatory changes, and technological advancements, you can make well-rounded decisions that align with your financial goals in this fast-paced environment.

User Queries

What is the main difference between Bitcoin and Ethereum?

Bitcoin is primarily a digital currency used for peer-to-peer transactions, while Ethereum is a decentralized platform that enables smart contracts and decentralized applications.

How do you evaluate the potential of an altcoin?

Evaluating an altcoin involves analyzing its use case, the technology behind it, market trends, team experience, and community support.

Are altcoins safer investments than Bitcoin?

Altcoins can be riskier than Bitcoin due to their lower market capitalization and higher volatility, making thorough research essential before investing.

What are utility tokens and security tokens?

Utility tokens provide access to a service or product, while security tokens represent ownership and are subject to regulatory securities laws.

How can I diversify my crypto portfolio?

Diversifying your crypto portfolio can be achieved by investing in a mix of established cryptocurrencies like Bitcoin and Ethereum, along with potential high-growth altcoins.