Bitcoin Ethereum Kurs Dollar Overview And Insights

Kicking off with bitcoin ethereum kurs dollar, the dynamic world of cryptocurrency has drawn increasing attention as investors seek alternatives to traditional financial avenues. Bitcoin and Ethereum, two of the most prominent digital currencies, have showcased fascinating price movements and technological advancements that are reshaping the financial landscape.

Understanding the fundamental differences between these two cryptocurrencies, their historical price trends, and the impact of current market dynamics is essential for anyone looking to navigate the complex world of digital assets.

Overview of Bitcoin and Ethereum

Bitcoin and Ethereum are two of the most recognized cryptocurrencies in the market today. While both operate on blockchain technology, they serve different purposes and have distinct features that set them apart. Bitcoin is primarily a digital currency designed for peer-to-peer transactions, while Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (DApps).Historically, the price trends of Bitcoin and Ethereum have demonstrated significant volatility.

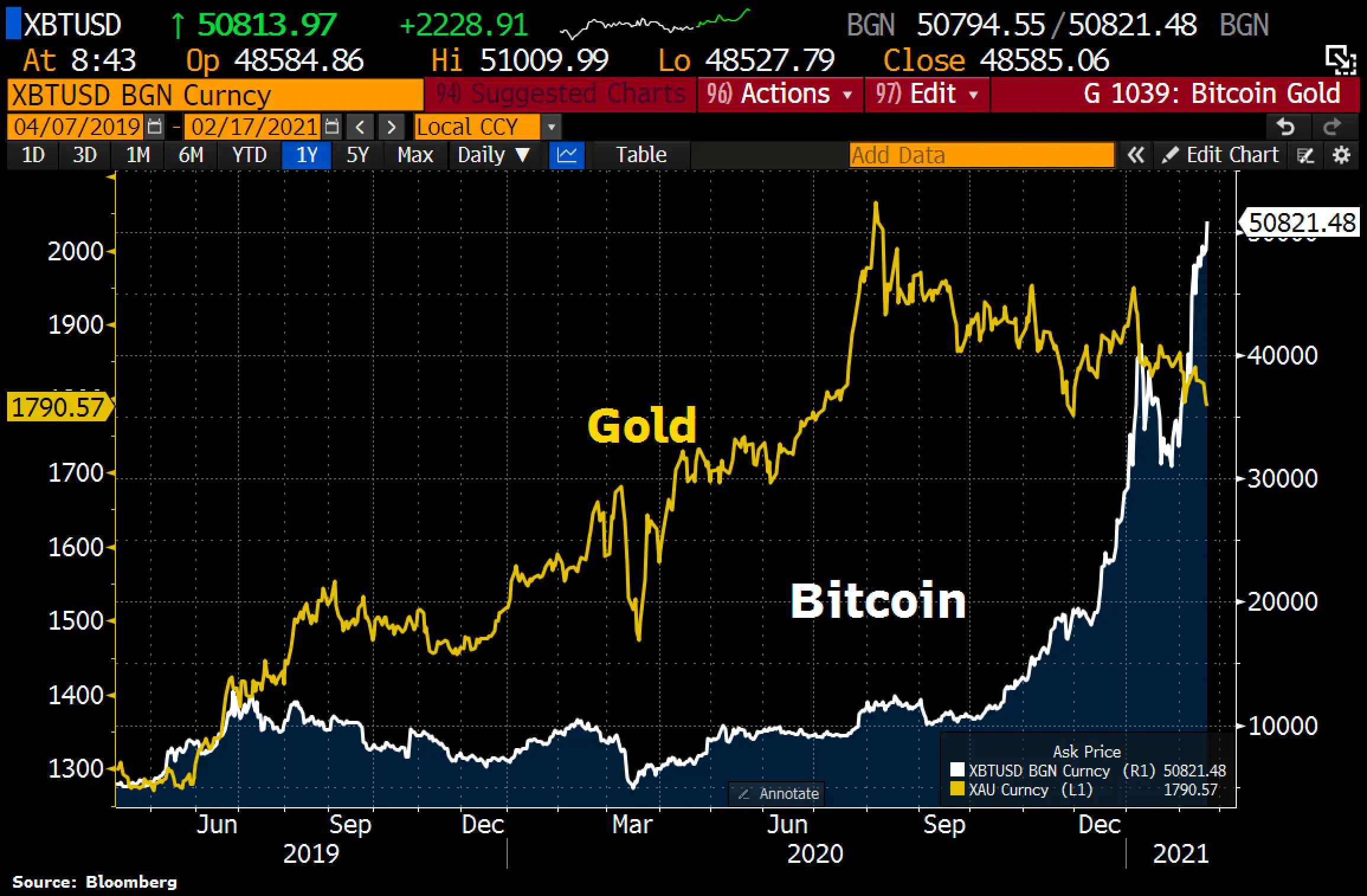

Bitcoin, being the first cryptocurrency created in 2009, has seen its price skyrocket from mere cents to tens of thousands of dollars over the years. Ethereum, launched in 2015, has also experienced substantial price fluctuations, influenced by its growing adoption and technological advancements. The market capitalization of Bitcoin often dwarfs that of Ethereum, which plays a critical role in shaping the overall cryptocurrency market.

As of late 2023, Bitcoin remains the dominant player, with a market cap of over $500 billion, while Ethereum’s market cap stands around $200 billion.

Current Market Trends

The current market trends for Bitcoin and Ethereum reveal that both cryptocurrencies are experiencing renewed interest from investors. As of now, Bitcoin is trading around $35,000, while Ethereum is valued at approximately $2,500. Recent geopolitical events, such as regulatory announcements and economic instability in various countries, have shown a direct impact on the courses of both cryptocurrencies. For instance, news of potential regulations in major economies has often led to fluctuations in their prices.Key market indicators that analysts monitor include trading volume, market sentiment, and network activity.

These factors can help predict future movements in Bitcoin and Ethereum prices. Increased trading volume often signifies heightened interest and can lead to price surges, while negative sentiments in the market can trigger sell-offs.

Investment Strategies

Investing in Bitcoin and Ethereum requires careful planning and strategy. A comprehensive guide for potential investors includes understanding the fundamentals of each cryptocurrency, analyzing market trends, and setting clear investment goals. Investors should consider dollar-cost averaging, which involves investing a fixed amount regularly, minimizing the impact of volatility.Risk management is essential in cryptocurrency investments. Techniques such as setting stop-loss orders, diversifying the investment portfolio, and only allocating a small percentage of total assets to cryptocurrencies can mitigate potential losses.

Diversifying a portfolio with Bitcoin and Ethereum can offer benefits such as exposure to high-growth assets, but it also comes with drawbacks, including increased volatility and the risk of regulatory scrutiny.

Technology and Development

The technological innovations behind Bitcoin and Ethereum play a crucial role in their value propositions. Bitcoin utilizes a proof-of-work consensus mechanism, ensuring security through mining. However, this method has raised concerns about energy consumption and scalability. In contrast, Ethereum is transitioning to a proof-of-stake model, which promises increased efficiency and scalability, allowing more transactions per second.Smart contracts are a significant innovation within the Ethereum network.

These self-executing contracts with the terms directly written into code enable trustless transactions and automation in various applications, from finance to supply chain management. Both cryptocurrencies face scalability issues, but proposed solutions vary. Bitcoin is exploring layer-two solutions like the Lightning Network, while Ethereum is implementing sharding and rollups to improve transaction speeds.

Regulatory Environment

The regulatory environment surrounding Bitcoin and Ethereum has a profound impact on their trading dynamics. Countries around the world are either embracing or restricting the use of cryptocurrencies. Recent legal changes, such as the European Union’s Markets in Crypto-Assets (MiCA) framework, aim to create a more structured environment for crypto assets, which could increase legitimacy and investor confidence.A list of countries embracing cryptocurrencies includes nations like El Salvador, which has adopted Bitcoin as legal tender, and Switzerland, known for its friendly crypto regulations.

On the other hand, countries like China have imposed strict bans on cryptocurrency trading and mining, highlighting the ongoing struggle between innovation and regulation in the crypto space.

Future Predictions

Expert opinions on the future value of Bitcoin and Ethereum suggest a mixed outlook. Some analysts predict that Bitcoin could reach $100,000 or even higher within the next few years, driven by institutional adoption and limited supply. Conversely, Ethereum’s price trajectory is expected to benefit from its technological advancements and growing use cases in decentralized finance (DeFi) and non-fungible tokens (NFTs).Scenario analysis indicates that in a bull market, both cryptocurrencies could experience exponential growth, while in a bear market, they may face significant downward pressure.

Challenges such as regulatory changes, technological hurdles, and market competition could pose risks, but ample opportunities exist for innovation and mainstream adoption in the coming years.

Final Review

In conclusion, the evolving nature of bitcoin and ethereum kurs dollar offers both challenges and opportunities for investors and enthusiasts alike. By staying informed about market trends, investment strategies, and regulatory developments, individuals can make savvy decisions in this fast-paced environment. The journey into the world of cryptocurrencies may be intricate, but the potential rewards are undeniably enticing.

Common Queries

What is the main difference between Bitcoin and Ethereum?

Bitcoin is primarily a digital currency used for peer-to-peer transactions, while Ethereum is a platform that enables developers to create smart contracts and decentralized applications.

How do geopolitical events affect Bitcoin and Ethereum prices?

Geopolitical tensions can lead to increased volatility in cryptocurrency prices, as investors often turn to digital currencies as a safe haven during uncertain times.

What are the risks of investing in Bitcoin and Ethereum?

Investing in cryptocurrencies involves risks such as market volatility, regulatory changes, and security concerns, which can impact investment outcomes.

How can I secure my Bitcoin and Ethereum investments?

Utilizing hardware wallets, two-factor authentication, and keeping software updated can help secure your cryptocurrency investments from hacks and theft.

What are potential future trends for Bitcoin and Ethereum?

Future trends may include increased adoption of cryptocurrencies for everyday transactions, advancements in blockchain technology, and evolving regulatory landscapes.